Learning how to implement a consistent invoicing process is crucial to your business’s operations.

Accurate and timely invoices ensure that you and your customers can manage and adhere to expectations such as pricing and delivery deadlines.

Additionally, if you’re trading within the UK and are VAT registered, HMRC legally obliges you to submit additional VAT information on your invoices.

In this article, we’ll run through the general HMRC invoice requirements depending on what type of business you run, as well as how they are affected by overseas trading. We’ll also explore how you can handle overdue invoices and why record-keeping is essential for both your business and satisfying HMRC.

No matter the size or nature of your business, you must provide accurate invoices when trading goods and services in the UK.

HMRC invoice requirements state that your invoices must include:

Top Tip: It’s imperative to use the right type of invoice and fill it out accurately. You’ll reduce the risk of confusion, and your clients will easily figure out how much they need to pay you (and by when). To learn more check out our in-depth guide on what an invoice is and how to raise one 💣

In order to satisfy HMRC invoice requirements as a sole trader, you must also include:

If you operate as a limited company, you must include the full company name as it appears on your certificate of incorporation.

You’re not required to include company director names. However, if you choose to include one director, you’ll need to name them all.

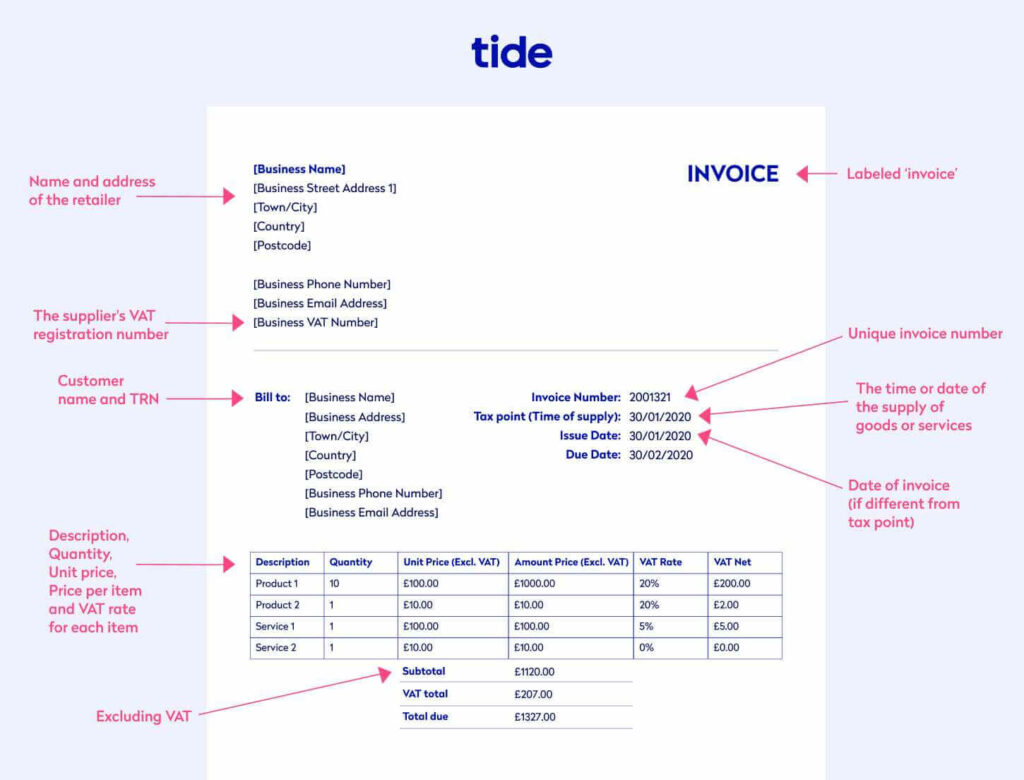

If you’re a VAT registered company, you are subject to additional HMRC invoice requirements.

When invoicing as a VAT registered company, you must:

If you issue full VAT invoices, they must include all of the information in a regular invoice (which we outlined earlier) as well as:

Top Tip: If you’re a VAT registered company, it’s critical that you understand the fundamentals of VAT. For a comprehensive guide to current VAT rates, how to register for VAT and how to charge VAT correctly, check out our article on everything you need to know about VAT 💭

*Note: The tax point displayed on your invoices can vary across transactions. For more information on identifying the tax point for your full VAT invoices, visit the GOV.UK website.

Here is an example of a full VAT invoice:

You can issue full invoices for any amount, but modified VAT invoices are issued for products and services over the value of £250. They are identical to full VAT invoices; however, they also detail the total amount owed for each line item, including VAT.

Here’s an example of what a modified VAT invoice looks like:

You can issue a simplified VAT invoice for sales under the value of £250 (including VAT). As the name suggests, this document contains far fewer details.

A simplified invoice only needs to include a unique invoice number, your business name and address, your VAT number, the tax point, a description of the goods or services and the rate of VAT on each item.

Unlike a full or modified invoice, you do not need to provide:

Here’s an example of a simplified VAT invoice:

Top Tip: You can also add VAT to invoices with Tide invoicing. Simply open your Tide app, create your personalised invoice, add VAT, choose payment terms, and send away 🎉

Bonus: Not yet a Tide member? To create and send your own VAT invoices today, access our library of free invoice templates 🔥

You will not be required to issue a VAT invoice if:

*Note: If you issue an invoice for goods and services at regular, reduced, or zero-rated VAT rates (20%, 5% and 0%) you must still include the reduced rate on the invoice.

Visit the GOV.UK website for more information on VAT margin schemes.

If you’re a business in the UK and provide goods and services to consumers, you are legally required by HMRC to issue and record invoices.

According to HMRC, a receipt is simply an acknowledgement of payment for goods and services, and you are not legally required to provide one.

However, they can come in very handy for customers who like to keep an eye on spending habits or if they require proof of purchase down the line.

If you’re trading goods and services outside of the UK, or provide VAT invoices in a foreign currency or language, ensure that you:

Top Tip: To learn more about how to add VAT to invoices for goods or services you sell to customers outside of the UK, read our guide to VAT rules and rates on exports 👀

HMRC invoice requirements dictate that you convert all foreign currency trades into sterling.

To convert foreign currency into sterling, you can:

If you operate under or use the Tour Operator Scheme, there are different rules that apply to you when accounting for VAT. Visit the GOV.UK website to find out more.

Best practice is to establish payment terms (e.g., payment options) and due dates in advance of issuing invoices to your customers. This way, you’re more likely to deliver goods and services in a timely manner and receive your payment just as promptly.

If you haven’t made special payment arrangements, you have a right to be paid within 30 days of issuing your invoice.

You also have the right to charge statutory interest on overdue payments. For more information on statutory interest and bank rates, read this guide on the GOV.UK website.

Top Tip: Chasing overdue invoices takes time and resources. Still, there’s no guarantee that your effort will pay off. To protect yourself against nonpayment and keep your cash flow steady, you may want to consider invoice financing. To learn more, read our guide to invoice financing ⚡️

Overdue payments are common pain points, especially for small businesses. In fact, our study found that UKE SMEs are chasing £50 billion in late payments.

Luckily, HMRC have standardised some methods you can use to chase up late payments.

If you decide to hire a mediator, you’ll be assigned an impartial individual trained in dispute resolution.

This is often the best route to go down, as it is cheaper than acquiring a solicitor and taking disagreements to court. The fee is usually calculated based on the overdue payment, too.

You can visit civilmediation.org to enquire about mediation services or, if you’re in Scotland, the scottishmediation.org website.

In the case of a particularly uncooperative customer, you can take it up a notch and make a court claim for the balance unpaid.

If the money you’re attempting to claim is under the value of £100,000 and owed by no more than two individuals or organisations, you can make a claim on the GOV.UK website.

Otherwise, you must apply to a county court. Visit the GOV.UK website to learn how you can apply for court action, as the process can vary across regions such as Northern Ireland and Scotland.

You (or any creditor) are entitled to make a statutory demand for late payments. You will not need a solicitor for this process. Statutory demand forms can vary by region and case nature, so visit the GOV.UK website for more information.

Once your customer has been issued a statutory demand, they will have 21 days to either pay the amount due or reach a renewed agreement with you.

If your client ignores your statutory demand, or cannot pay the amount owed, you have two options:

Chasing overdue invoices using these methods is costly, and you’re not guaranteed to get your money back, for example, if a company’s liquidated assets aren’t sufficient to cover the debt.

Top Tip: If you do run into legal issues with a client, you’ll need to be aware of your options moving forward. Learn how to seek mediation and legal advice with our guide to chasing overdue invoices (the right way) 👮

The easier it is for your clients to pay you, the less likely you are to run into the issues discussed above.

Let’s look at some of the ways you can incentivise your clients to pay you on time:

Keeping a record of your invoices serves many important functions.

Not only do your invoices act as proof of tax compliance in the event of an HMRC audit, they also allow you to keep an eye on your business’s finances and empower you to spot potential bumps in the road before they happen, such as a lack of cash flow.

Top Tip: It’s always a good idea to be up to date on small business accounting practices. Your operations, strategy and growth depend on effective and tactical accounting to keep an eye on your cash flow. Learn how to organise your accounts with our complete guide to small business accounting 💥

HMRC requires your records to include:

You must keep a separate record of VAT charged and paid in the form of a VAT account. You’ll use your VAT account to complete your VAT return and claim or pay HMRC for any overpaid or outstanding tax.

Top Tip: Your business’s financial health relies heavily on efficient expense management. Expenses are a huge factor in your cash flow equation, yet more than half of small business owners have experienced cash flow issues. Learn about the types of business expenses, why it’s important to monitor them and how to track them effectively with our complete guide on how to track expenses 💸

If you’re a VAT registered business with a taxable turnover (total value of sales which are not exempt from VAT) of £85,000 or more, you are required to keep digital copies of some of your records under the government initiative, Making Tax Digital for VAT.

As of April 2022, all businesses will be obligated to register for Making Tax Digital for VAT, regardless of their earnings.

Learn how to sign up for Making Tax Digital for VAT, what to include in your digital records, how to apply for an exemption and more on the GOV.UK website.

If you operate a retail business, you aren’t required to issue VAT invoices unless a customer requests one.

If you issue a VAT invoice to a customer, you must keep a copy for your records.

Additionally, if you sell items for under £250, you can take advantage of the simplified VAT invoice format discussed earlier.

If you return goods to a seller or a customer returns goods to you, you’ll often settle the balance with a debit or credit note.

These records must show the same information on the original VAT invoice, and also:

Accurate invoices not only help you to organise your business and keep on top of accounting, but they also satisfy HMRC invoice requirements and keep your business squeaky clean.

They provide a transparent overview of your cash flow, act as proof of transaction in the event of uncooperative clients and assure HMRC that you’re tax compliant.

Photo by Loe Moshkovska, published on Pexels

18 Jun 2021

18 Mar 2022

28 Oct 2022

Tide is about doing what you love. That’s why we’re trusted by 575,000+ sole traders, freelancers and limited companies throughout the UK.

Tide Platform Limited (Tide) designs and operates the Tide website and app. Tide is not a bank.

Tide is authorised by the Financial Conduct Authority (FCA) under the Electronic Money Regulations 2011 under firm reference number 900843 for the issuing of electronic money and the provision of payment initiation services and account information services under the Payment Services Regulations 2017. Tide is also authorised and regulated by the Financial Conduct Authority in relation to its credit and insurance broking activities (firm reference 718743). Tide is incorporated and registered in England and Wales with company number 09595646 and registered office at 4th Floor The Featherstone Building, 66 City Road, London, EC1Y 2AL.

Tide offers bank accounts provided by ClearBank® Ltd (ClearBank) (account sort code is 04-06-05). ClearBank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under registration number 754568. Eligible deposits with ClearBank are protected up to a total of £85,000 by the Financial Services Compensation Scheme (FSCS), the UK's deposit guarantee scheme. For further information visit fscs.org.uk.

Some of Tide’s members also hold e-money accounts provided by PrePay Technologies Limited (PPT) (account sort code is 23-69-72). PPT is an electronic money institution authorised by the FCA under the Electronic Money Regulations 2011 under firm reference number 900010 for the issuing of electronic money. PPT holds an amount equivalent to the money in Tide current accounts in a safeguarding account which gives customers protection against PPT’ insolvency.

Tide Cards may be issued by both Tide and PPT, who are licensed by Mastercard International for the issuance of cards. The issuer of your Tide card will be identified on your monthly card statement.

Tide, the Tide logo, the Swell, and Do less banking are trademarks and trade names of Tide Platform Limited, and may not be used or reproduced without the consent of the owner.